City May Adopt Tax Increment Financing Plan That Temporarily Exempts Improvements to Annexed Land From Both City and Township Property Taxes

Notwithstanding Township’s Continued Taxing Authority Under ‘Type 2’ Annexation

Supreme Court reverses Second District Court of Appeals decision involving taxing of annexed property in Sugarcreek Township.

Supreme Court reverses Second District Court of Appeals decision involving taxing of annexed property in Sugarcreek Township.

The Supreme Court of Ohio held today that when land in a township has been annexed by an adjacent municipality through an “expedited type-2” annexation pursuant to R.C. 709.023, although the annexed property remains a part of the township and remains “subject to the township’s real property taxes,” the municipality may adopt a tax-increment financing plan (TIF) that temporarily exempts from city and township property taxes a portion of the improvements made to the annexed property to encourage that property’s economic development.

The court’s 7-0 decision, which reversed a decision of the Second District Court of Appeals, was authored by Justice Judith Ann Lanzinger.

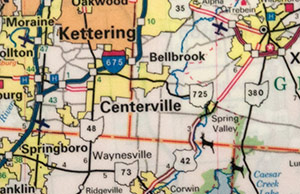

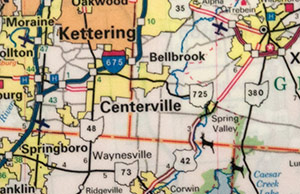

The case involved 268 acres in Greene County located on both sides of Interstate 675 at the Wilmington Pike interchange in Sugarcreek Township. In 2006, with the consent of 100 percent of the affected property owners, the property was annexed by the adjacent city of Centerville through an “expedited type-2” annexation. Under R.C. 709.023, enacted by the General Assembly in 2001, property annexed via the expedited type-2 process becomes part of the annexing municipality, but unless the parties agree otherwise, it also remains a part of the township and “remains subject to the township’s real property taxes.”

The annexation agreement between the property owners and Centerville specified that a third-party developer intended to purchase the annexed land from the owners, and that the city intended to designate the property a TIF district pursuant to R.C. 5709.40 – a state law that authorizes municipalities to encourage economic development by creating “incentive districts” in which improvements to real property are temporarily exempted from property taxes. Instead of paying real estate taxes, the owners of exempted property make service payments to cover the cost of public improvements in the incentive district, such as roads, water and sewer lines, or environmental remediation. Unless approval has been obtained from affected boards of education, a TIF may last no longer than ten years, and may exempt only up to 75 percent of the taxes on the improvements to the real property within the district.

In September 2006, before the annexation was completed, Sugarcreek Township filed suit in the Greene County Court of Common Pleas seeking in part a declaratory judgment that Centerville could not establish a TIF as the property owners and the City had agreed to do. The trial court granted the township’s motion for partial summary judgment on the TIF issue, declaring that because a TIF would divert real estate taxes from the township in violation of R.C. 709.023, the city could not implement a TIF on the annexed land of the township.

After an initial review of the case by the Second District Court of Appeals resulted in a remand to the trial court, which was followed by a second appeal, the court of appeals held that because the property in question had been annexed through a type-2 annexation, and therefore remained “subject to the township’s real property taxes” under R.C. 709.023(H), any TIF created by the city could not exempt improvements to the annexed property from full taxation by the township.

Centerville sought and was granted Supreme Court review of the Second District’s judgment.

Writing for a unanimous court in today’s decision, Justice Lanzinger disagreed with the township’s argument that reading R.C. 709.023(H) to allow township taxes on type-2 annexed land to be exempted through a TIF would render the concluding “remains subject to the township’s real property taxes” clause of the statute superfluous.

Justice Lanzinger wrote: “(The Township) asserts that a township’s ability to tax annexed land is implicit in the statute and that a municipality can never divert any taxes from the township. We do not agree. The two clauses are not independent sentences. The ability to tax is a result of the fact that the territory remains a part of the township. We accordingly read the final clause of R.C. 709.023(H) to set forth the consequences of retaining the annexed land rather than provide for the township’s inviolable right to collect any taxes that may arise from annexed property. Furthermore, because R.C. 5709.40 does not take away a township’s right to collect taxes on property subject to an expedited type-2 annexation, the statute does not contradict R.C. 709.023.”

“This interpretation is bolstered by R.C. 5709.40(F), which enumerates types of tax levies for which the municipality or township will receive funds despite the TIF that directs service payments toward public infrastructure improvements. Included among those levies not affected by the TIF are those for developmental-disability programs, county hospitals, mental-health services or facilities, and libraries. Although R.C. 5709.40(F)(8) lists taxes levied for the support of township park districts, there is no listing for township real property taxes to be excepted from the TIF. Because the legislature chose not to provide a TIF exception for township real property taxes, we will defer to the legislature’s discretion rather than write one into the statute ourselves.”

“The Township asserts that by diverting a portion of the tax on the increased property value, the City interferes with the Township’s collection of taxes that it would otherwise be able to obtain. We do not agree that a TIF violates R.C. 709.023(H). Unless the affected boards of education approve a higher percentage, R.C. 5709.40(C)(4) caps the amount of taxes that may be exempted under the TIF at 75 percent. Townships continue to collect their full share of taxes on the unimproved portion of the property. In addition, they may collect their share of the taxes on the improvements to the property—in one sense, a tax windfall that might not have existed without the TIF. Viewed in this light, the TIF enhances rather than interferes with the Township’s ability to collect taxes.”

“(W)hile R.C. 709.023(H) ensures that the annexed land ‘remains subject to the township’s real property taxes,’ the statute does not grant townships the unfettered ability to collect any and all taxes that may arise from the real property or improvements to the real property. The annexing municipality may accordingly adopt a tax-increment financing plan under R.C. 5709.40 that temporarily exempts improvements to the annexed property from city and township property taxes to support the annexed property’s economic development.”

Please note: Opinion summaries are prepared by the Office of Public Information for the general public and news media. Opinion summaries are not prepared for every opinion, but only for noteworthy cases. Opinion summaries are not to be considered as official headnotes or syllabi of court opinions. The full text of this and other court opinions are available online.

2011-0926. Sugarcreek Twp. v. Centerville, Slip Opinion No. 2012-Ohio-4649.

Greene App. No. 2010-CA-52, 193 Ohio App.3d 408, 2011-Ohio-1830. Judgment reversed and cause remanded.

O’Connor, C.J., and Pfeifer, Lundberg Stratton, O’Donnell, Lanzinger, Cupp, and McGee Brown, JJ., concur.

Opinion: http://www.supremecourt.ohio.gov/rod/docs/pdf/0/2012/2012-Ohio-4649.pdf

View oral argument video of this case.

View oral argument video of this case.

Acrobat Reader is a trademark of Adobe Systems Incorporated.